Trade the Future, Not the Past

Utilize our state-of-the-art AI-driven models to forecast cryptocurrency prices, risk, and volatility with quantifiable accuracy.

Request a Technical WhitepaperOur Proprietary Modeling Engine

Data Ingestion

Sonic Labs processes over 10TB of raw data daily, from tick-level order books to on-chain gas fees, ensuring a comprehensive data foundation.

Feature Engineering

Our system identifies thousands of predictive features, from simple moving averages to complex network topology metrics, maximizing signal discovery.

Ensemble AI Models

We combine Recurrent Neural Networks (RNNs), Long Short-Term Memory (LSTMs), and Gradient Boosted Trees for robust, self-correcting forecasts.

Signal Delivery

Signals are delivered via a low-latency API or a custom dashboard, precisely tailored to integrate with your existing trading systems.

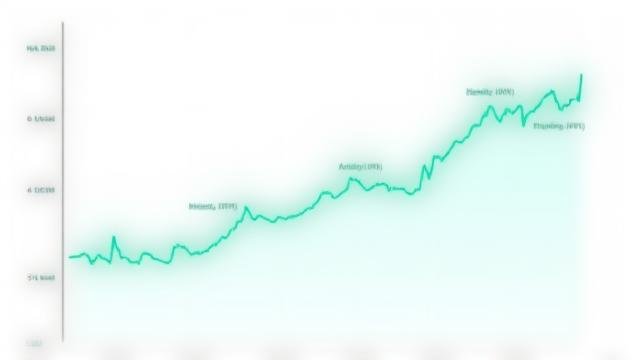

Accuracy You Can Measure

Simulated P&L Growth

3.5+

Consistent Sharpe Ratio

Achieved in rigorous backtesting across diverse market conditions, indicating superior risk-adjusted returns.

78%

Directional Accuracy

Predicting short-term price movements over a 24-hour period with high reliability.

Volatility Forecast vs. Actual

Applications for Your Strategy

For Quant Funds

Integrate our low-latency signals directly into your execution algorithms to enhance alpha generation. Our models provide a robust edge in high-frequency trading and systematic strategies.

- Optimized Entry/Exit Points

- Enhanced Alpha Generation

- Reduced Slippage

For Market Makers

Use our hyper-accurate short-term volatility forecasts to dynamically price options, manage inventory risk, and optimize spread settings with unprecedented precision.

- Dynamic Spread Optimization

- Real-time Risk Management

- Improved Bid-Ask Efficiency

For Asset Managers

Leverage our macro-factor models to inform asset allocation and regime shift decisions, ensuring your crypto portfolios remain resilient and optimally positioned.

- Strategic Asset Allocation

- Proactive Portfolio Rebalancing

- Regime-based Risk Management

For Corporate Treasuries

Hedge your digital asset holdings more effectively with our granular risk-factor predictions. Minimize exposure to volatility and protect your balance sheet with foresight.

- Optimized Hedging Strategies

- Balance Sheet Protection

- Enhanced Financial Stability

Technical & Implementation Questions

Access the Future of Crypto Intelligence

Dive deep into our methodology, backtested performance, and seamless integration process. Our team is ready to walk you through how our predictive models can fit into your workflow and propel your strategy forward.